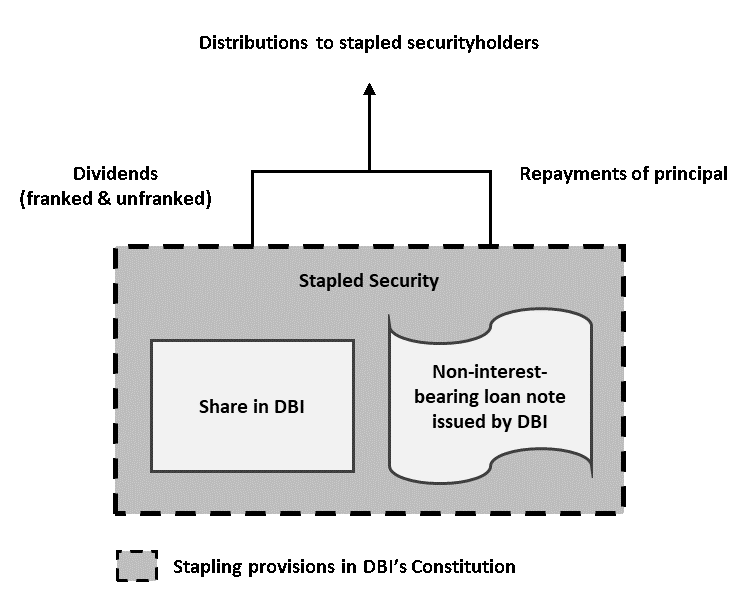

Distribution Components

DBI is an Australian resident company incorporated under the Corporations Act 2001 (Cth) and therefore is neither a managed investment trust (MIT) nor an attribution managed trust (AMIT) for the purposes of Australia’s withholding tax regime. DBI’s Stapled Securities comprise a single share in DBI and a non-interest-bearing loan note issued by DBI, stapled together under DBI’s Constitution on a one-to-one basis. Distributions paid by DBI will generally take the form of a dividend paid in respect of shares in DBI or a repayment of principal on the non-interest-bearing loan notes issued by DBI (or a combination thereof, refer to diagram below).

Accordingly, distributions paid by DBI do not include amounts referable to tax components normally notified to investors by MITs and AMITs in accordance with Subdivisions 12A-A and 12-F, and Subdivisions 12A-B and 12-H of Schedule 1 to the Taxation Administration Act 1953. For completeness, we note that DBI does not distribute Non-concessional MIT income components such as MIT cross staple arrangement income.

Custodians should refer to distribution statements provided to Securityholders in respect of each distribution for further information on the nature of each distribution paid by DBI which should assist in determining withholding obligations in respect of DBI’s distributions on-paid to non-residents.